Exhibit B -- Specifics of the Loan

Non-California Residents

Must Purchase the Entire Loan

Loan Number: N2555

Loan Amount: $400,000

Minimum Investment: $20,000

Call for availability of smaller participations

Type: First Trust Deed

Yield: 8.0%*

Important Links:

How to Invest in This Loan

Suitability Requirements

Offering Circular

Loan Servicing Agreement

Audited Financial Statement for B & S

Inventory of Available Loans

To Be Added to Our Investor Email List

PROPERTY

Project: Perryton Industrial

Property Address: 702 SE 1st Avenue, Perryton, TX 79070

Description: The subject properties consist of 47,810SF of office, warehouse, & truckshop space on 5.141 acres located in Perryton, Texas

For an aerial view....Click Here!

For a streetl view....Click Here!

TERMS

Term of Investment |

60 months |

Current Interest Rate |

8.0%* |

Repayment Schedule |

30 Year Amortization |

Monthly Payment |

$2,847.43*

|

Purchase Price of the Note |

$400,000 |

Current Balance on the Note |

$400,000 |

Maturity Date |

60 months |

Balloon Pymt. after 60 months app. |

$389,519.88 |

Late Charge Amount |

$348.08** |

Prepayment Penalty |

None |

*Net of servicing

**To be shared equally with B&S

EQUITY ANALYSIS

Appraised Value - December 6, 2019 |

$1,200,000 |

Protective Equity |

$800,000 |

Loan-to-Value Ratio Appraised Value |

33.3% |

OPERATING STATEMENT - COMBINED

INCOME |

|

Rental Income |

$143,430 |

Less 5% Vacancy Allowance |

$7,172 |

| Effective Gross Income | $136,258 |

EXPENSES |

|

Miscellaneous |

$6,813 |

| Total Expenses | $6,813 |

NET OPERATING INCOME |

$129,445 |

Note: Pro Forma based on the appraiser's estimates |

BORROWERS

Name(s) |

LLC |

Net Worth |

$750,796 |

| 2018 Net Income | $24,781 |

| 2017 Net income | $8,426 |

| Occupation | Real Estate Holding |

| Percent Ownership | 100% |

Name(s) |

INDIVIDUAL(S) |

Net Worth |

$3,189,120 |

His Occupation |

President |

| Her Occupation | Teacher |

| His Employer | Hi-Plains Trading Co. |

| 2018 Income | $204,200 |

| 2017 Income | $104,431 |

Name(s) |

INDIVIDUAL(S) |

His Occupation |

Secretary/Treasurer |

Her Occupation |

Real Estate Agent |

| His Employer | Hi-Plains Trading Co. |

| Her Employer | Century 21 |

| 2018 Income | ($606,584) |

| 2017 Income | ($386,343) |

Earn a $250 Referral Fee |

To invest, please call |

PERRYTON INDUSTRIAL

Angela says, “In my experience, seasoned investors usually have narrowed down their “must-have terms” when considering a private-money offering. If you are one of those investors, this particular trust deed offering may touch on one, or many, of those. Some of the highlights of this offering are (1) the LTV is low, i.e. 33.3% (based on an AS-IS fee simple appraisal), (2) the appraised value is supported by a drive-by, broker professional opinion, (3) the loan is personally guaranteed by two husband/wife couples, each with credit of 667/607 and 791/803, and (4) subject property is located in Texas, which is a Deed of Trust state. If you have yet to clearly define your “must-have terms”, that is ok! Please read George’s Advice of Successful Investing found at the bottom of this offering. His wise counsel may be the missing piece in determining if this offering is a fit for your portfolio.”

Blackburne & Sons is pleased to present this new first trust deed secured by 5.141 acres, improved with 47,810SF of office, warehouse and truck shop space in a smaller community known as Perryton, Texas.

The purpose of this first trust deed is to refinance the existing loan. Borrowers will be required to come to closing with an estimated $24,488.70 cash, to bridge the gap between this new loan and the payoff of the existing lien.

COUNTY and CITY INFORMATION

Ochiltree County is located in northern Texas, bordering Oklahoma. The county seat, and only city, is Perryton. There are two smaller communities in the county, Farnsworth and Waka, located southwest of Perryton along State Highway 15. As of 2016, Ochiltree County had an estimated population of 10,306.

Perryton, the county seat, lies seven miles south of the Oklahoma Panhandle border and the surrounding area is often referred to as the Great Wheat Belt of the Southwest. The population was 8,802 at the 2010 census. State Highway 15 provides service from the smaller communities southwest of Perryton and on to other communities in the extreme northeastern panhandle.

A nearby county-operated airport provides service for smaller aircraft with a 5,000-foot paved and lighted runway. According to the appraiser, the economic conditions in the City of Perryton and in Ochiltree County have been fairly stable, with some growth occurring over the past few years due to an increase in old and gas drilling in the area.

SUBJECT PROPERTY DETAILS

The subject neighborhood is located in eastern part of Perryton. Light industrial land uses predominate, i.e. oil production and servicing companies, transportation and agricultural equipment servicing businesses and light manufacturing. Vacant land is available in the neighborhood.

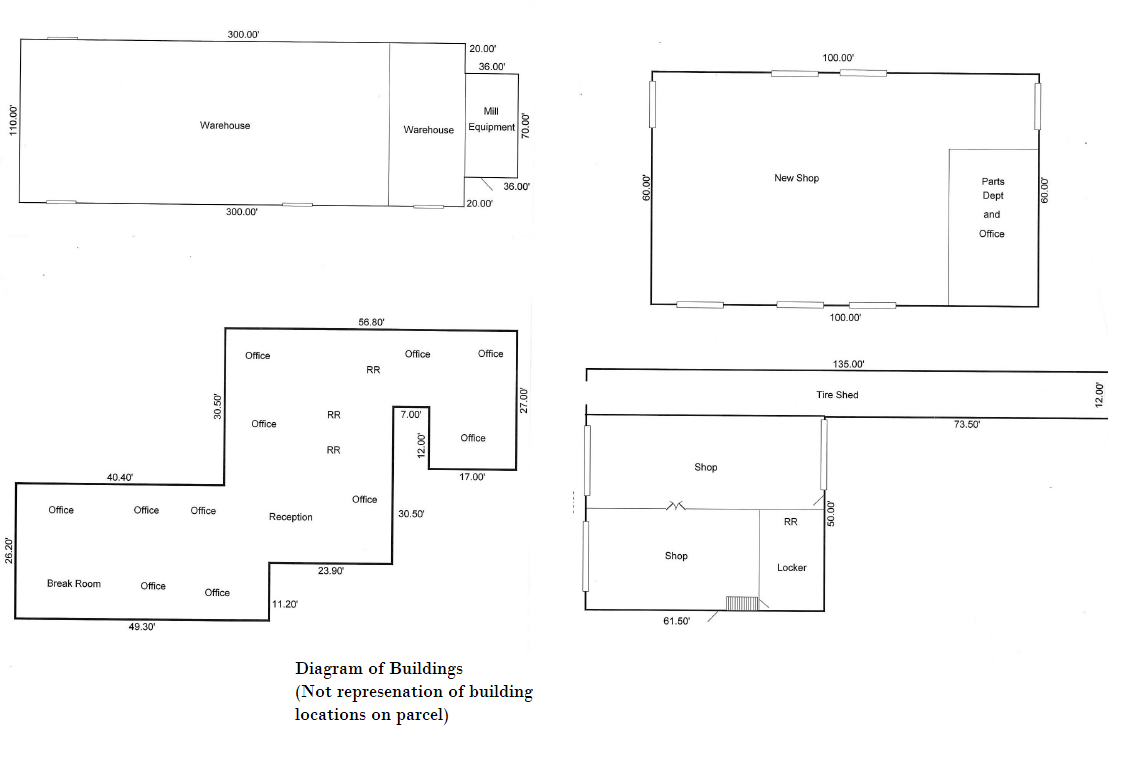

Improvements on the 5.141 acres consists of a total 47,810SF of combined office, warehouse and truck shop space. Four buildings make up the total improvements; a 3,215SF wood frame office building, a 3,075sf metal truck shop, a 6,000SF truck maintenance shop and a 35,520SF metal warehouse. Each of these buildings are described in greater detail below.

Office Building – This 3,215SF building has a concrete slab foundation and composition shingles on a gable roof. The building is irregular in shape. The interior is partitioned into private offices, restrooms, storage and work areas, and a break room. Interior finish includes vinyl, tile, and stained concrete floors, drywall partitions, acoustic tile ceilings, and central refrigerated HVAC. According to the appraiser, condition and maintenance are average.

Metal Truck Shop – This 3,075SF building is constructed of a concrete slab foundation and a metal roof. Half of the building is partitioned as a drive-thru general truck maintenance bay with overhead doors. The other half has an overhead door and a small locker room area with restroom. A metal tire shed runs along the building’s south wall. According to the appraiser, condition and maintenance of this building is good.

Metal Warehouse – The largest of all the building, this 35,020SF building is partitioned into hull storage space and a machinery housing area. A five-bay, recessed truck loading dock is located at the southeast corner of the building. According to the appraiser, condition and maintenance are average to fair.

BORROWER SUMMARY

Title to this owner occupied property is held through a Texas limited liability company (LLC). This loan will be personally guaranteed by two husband and wife couples, who are related by marriage. The LLC is a real estate holding company and generated taxable income of $24,781 in 2018 and $8,426 in 2017.

The first married couple includes a company president and teacher. They reported a taxable income of $204,100 in 2018 and $104,431 in 2017, and have mid-credit scores of 667 and 607, respectively.

The second married couple are employed as a secretary/treasurer and real estate agent. They reported a taxable income of ($606,584) in 2018 and ($383,343) in 2017. These guarantors have a mid-credit scores of 791 and 803, respectively. Losses for these tax years are attributed to two outside businesses owned by the guarantors. Letter of explanation will be provided in the due diligence package.

Combined, both couples have a reported net worth of $3,189,120.

VALUATION SUMMARY

A local, state-certified appraiser was engaged who valued this property at $1,200,000 AS-IS. We also engaged a local commercial broker who drove by the subject property and performed an as-is opinion of value, concluding a value of $1,123,535.

At an 8.0% yield to the investors, and a 33.3% LTV (Appraised Value), this appears to be a reasonable investment. Investing in any first trust deed involves substantial risk, so be sure to read the Risk Factors section of the Offering Circular carefully before investing. A large and prolonged decline in real estate values is possible. Foreclosed commercial properties almost always need to be renovated before they can be leased or sold, so be sure to maintain some liquidity.

George’s Advice For Successful First Trust Deed Investing

- You should spread your mortgage investment portfolio out among lots of different deals. If you have $300,000 to invest, you should invest $10,000 to $20,000 in 15 to 20 different fractionalized first trust deeds. For example, if the deal is a $300,000 first trust deed on an office building in Boise, with a $15,000 investment you would own 5% of the loan. By spreading your money out into a bunch of different deals, you are achieving the diversity of a fund without the failed fund sponsor problem. If you are extremely wealthy, you could double (or even triple) my suggested investment amounts, but be careful about pouring too much money into a single deal. We once had a whole building fall into an old coal mine. Ouch.

- Be wise and resist investing in any first trust deed yielding more than 9%. I would personally never invest in a first trust deed with a double-digit yield. The payments slowly grind the borrowers into the dust.

- Blackburne’s Law theorizes that a portfolio of 8% and 9% first trust deeds will outperform a portfolio of 11% and 12% first trust deeds over a seven-year term. Only our wisest (and eventually the happiest) investors listen to me.

- You can also buy some of our smaller deals in their entirety, but I only recommend this if you are richer than Crassus.

- It is very easy to lose money in hard money first mortgages, so fight-fight-fight against the temptation to invest in high-yield deals. As Nancy Reagan used to say, “Just say no.” But if you choose 7% to 9% first mortgages, I predict that you will be very, very pleased.

Earn a $250 Referral Fee |

To invest, please call |

Blackburne & Sons Realty Capital Corporation--For more information, contact George Blackburne, IV

4811 Chippendale Drive, Suite 101, Sacramento, CA 95841

Telephone: (916) 338-3232 * Fax: (916) 338-2328

Real Estate Broker -- California Department of Real Estate -- License Number 829677 -- NMLS Number 103430

Publicly advertised to California residents only under California Department of Business Oversight business plan permit.

Return to C-Loans Home Page | Return to Blackburne & Sons Home Page

Copyright © 2019 Blackburne & Sons Realty Capital Corporation. All rights reserved. (800) 606-3232